Budgeted Living Experiment: 1 month in

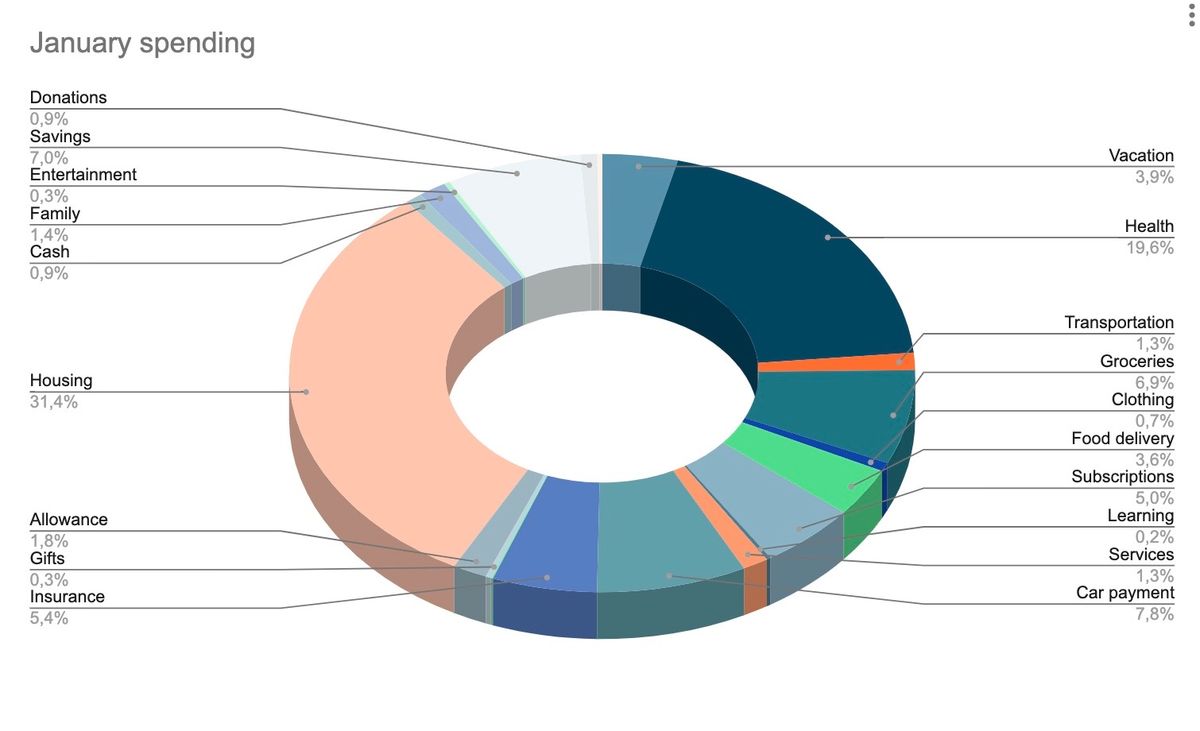

This is a summary after one month of my 3-month Budgeted Living Experiment. While I set a monthly budget of €5K, I actually spent €5,7K in the first month.

I keep reminding myself that this isn't a cost-saving experiment; it's merely trying to observe my spending and identify potential reserves if I might need them one day.

Housing

This category represented 31,4% of my spending or €1.793,- which includes mortgage payment, energy bills, cleaning lady, and the rent for my office. The latter represents over 50% of the total amount, and I can consider it a variable expense which I can cut on a short notice if needed.

Consequently, without this office rent and the related energy bills, I'd also spend less than €5K in January.

Health

This is the second biggest category, with a total spend of €1.120,-. Nearly €600 went for massages, and another €400 on physiotherapy. None of these are essential for my health; they are more of a well-being things, so I can consider them variable.

Only €154,- went for the monthly gym membership and minor things I consider essential for my Health and would like to keep them even if the money was tough.

Groceries

I spent a surprisingly low amount of groceries; merely €396,63 or less than 7% of total. But I can add the food deliveries to this category, which means another €205,30 (3,6%) on top, for a total of over 10% of monthly spend.

Other

Participating in Dry January meant I haven't spent anything on alcohol or parties in January, and that would quickly add up a couple of hundred euros if it would be there.

Learning points

What I learned observing my January spending is that I have a lot of reserves if I'd need to cut my spending. But I guess it's safe to assume that €6K is my "normal"-FIRE budget, putting my annual number at €72K, and the FIRE number at €1,8M.

Looking at my current liquid net worth (not considering the value of the primary real estate), I'm at about 10% of my FIRE journey (€177.350). Still a long way to go.

Comments ()