Recession contingency plan

Are you worried about the economy? Here are a few tips to help you prepare yourself for a recession.

How to prepare for the economic downturn

It's no secret that the economy is in a shaky place right now. Many businesses are struggling to stay afloat. As a result, layoffs have become all too common, and the unemployment rate is skyrocketing. If you're worried about losing your job, now is the time to start thinking about a recession contingency plan. In times like these, it's important to have a contingency plan in place in case of a recession. Here are a few things you can do to prepare your business for a downturn.

Why Recessions May Be Inevitable

Make a budget and stick to it.

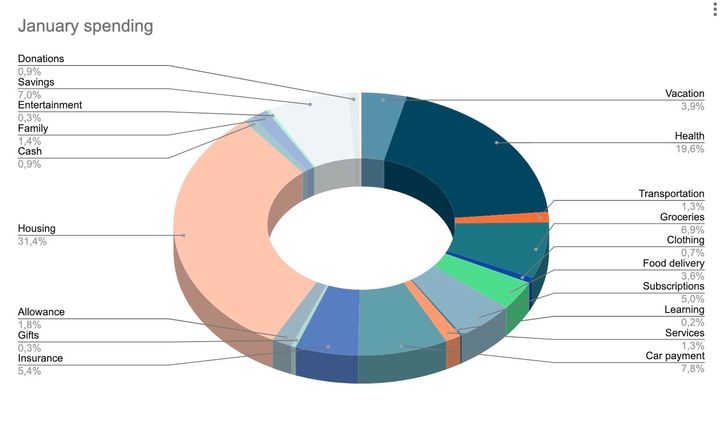

The first step in any recession contingency plan is to make a budget. Knowing how much money you have coming in and going out each month will help you weather any financial storms that may come your way. Once you have a budget in place, stick to it as closely as possible. That means cutting back on unnecessary expenses and putting more money into savings.

Build up an emergency fund.

A key part of any recession contingency plan is having an emergency fund to fall back on. This should be money that you set aside each month so that you have a cushion to cover unexpected costs if you lose your job or have your hours reduced. Aim to save at least three months' worth of living expenses so that you can weather any short-term financial challenges.

Consider freelance work or starting your own business.

If you're worried about losing your job, now is the time to start thinking about alternative sources of income. If you have some skills or talents that you can offer on a freelance basis, start marketing yourself to potential clients. Or, if you've always wanted to start your own business, this may be the perfect time to take the plunge. Having multiple streams of income will help you weather any financial challenges that come your way during a recession.

Lower your running costs

The next recession is coming, and we need to be prepared. That means cutting living expenses, especially discretionary spending. And try to minimize the amount of debt; it's what usually kills companies and individuals in times of recession.

Saving money is key during these times. Invest in yourself and your future by building up an emergency fund to cover at least six months of living expenses. This will help you weather the storm when the economy takes a turn for the worse.

Be mindful of your spending. Ask yourself if you really need that new pair of shoes or that fancy dinner out. When times are tough, we need to be smart with our money. So cut back on unnecessary spending and focus on saving for the future.

The Minimalists on Money

Five things you can do to lower your spending

- Review your monthly expenses and figure out where you can cut back

- Set a budget and stick to it - even if it means making some sacrifices

- Use cash instead of credit cards whenever possible so you can see exactly how much money you're spending

- Find cheaper alternatives to your regular expenses, like generic brands or discount stores

- Sell unused items online or at a garage sale to make some extra cash

Be frugal when you don't need to be

Living frugally when you don't have to is a great way to prepare for tough financial times. You'll learn where you can save and where you need to spend in order to live comfortably. It's also a great way to get out of debt.

Living frugally will help you become more aware of your spending habits and how to make the most of your money. Learning to be frugal now will pay off in the long run when you're faced with tough financial decisions. It's a smart way to prepare for the future and protect yourself from financial hardship.

This might be a wonderful opportunity to adopt a minimalist lifestyle:

Minimalism: A Documentary About the Important Things (Official Trailer)

Stay positive and stay prepared.

It's important to stay positive during tough times like these—but it's just as important to be prepared for anything that might come your way. By following these tips and putting together a solid recession contingency plan, you'll be ready for whatever comes next.

Comments ()