#FatFIRE start: my current financial situation

At first, I need to work out my starting line and figure out my objectives.

My #FIRE goals & rules

- Full #FatFIRE by 2030

- Saving at least 50% of monthly income

- journal & share the journey

Current financial status

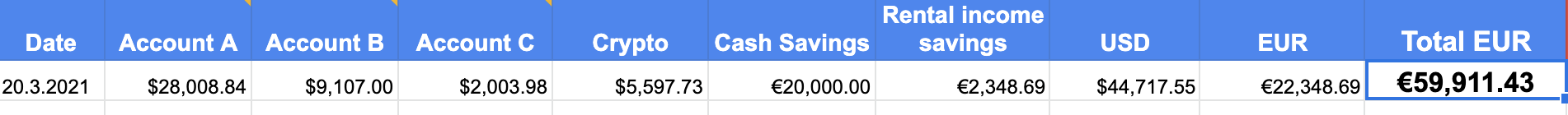

This is a snapshot of my current status:

- Investment account A (Stocks): $28K

- Investment account B (Stocks): $,9,1K

- Investment account C (Stocks): $2K

- Crypto: $5,5K

- Cash savings: €20K (~$23.8K)

- Rental income savings: €2,3K (~$2.7K)

- Total value: €59,9K, or ~$71,3K

I also have €20K left in car payments and €84K in the low-interest mortgage. The monthly rental income of €650 ($770) comes from a rental property that has no mortgage; it's fully paid off.

The mortgage payment is for our primary dwelling, and I'm not listing either one as equity, as I'm not planning to sell them off. I purposefully just sum up the current value on the rental income account. I usually leave there just enough to pay the taxes and move the rest of the money in my investment accounts.

Investment accounts

I have my reasons to have 3 investment accounts. One of them holds restricted stock that I received from my employer. It's currently worth $28K and will be fully vested by 2025, when it's estimated to be worth about $96K (at today's prices). That stock also pays dividends, and they DRIP (re-invest automatically), so there's some compounding magic going on.

Investment Account B is where I'm planning to build my long-term portfolio. It's a mixture of tech growth and some dividend stocks (DRIP!), and I'm planning to build it into a sort of DIY-Index Fund.

DIY Index Fund

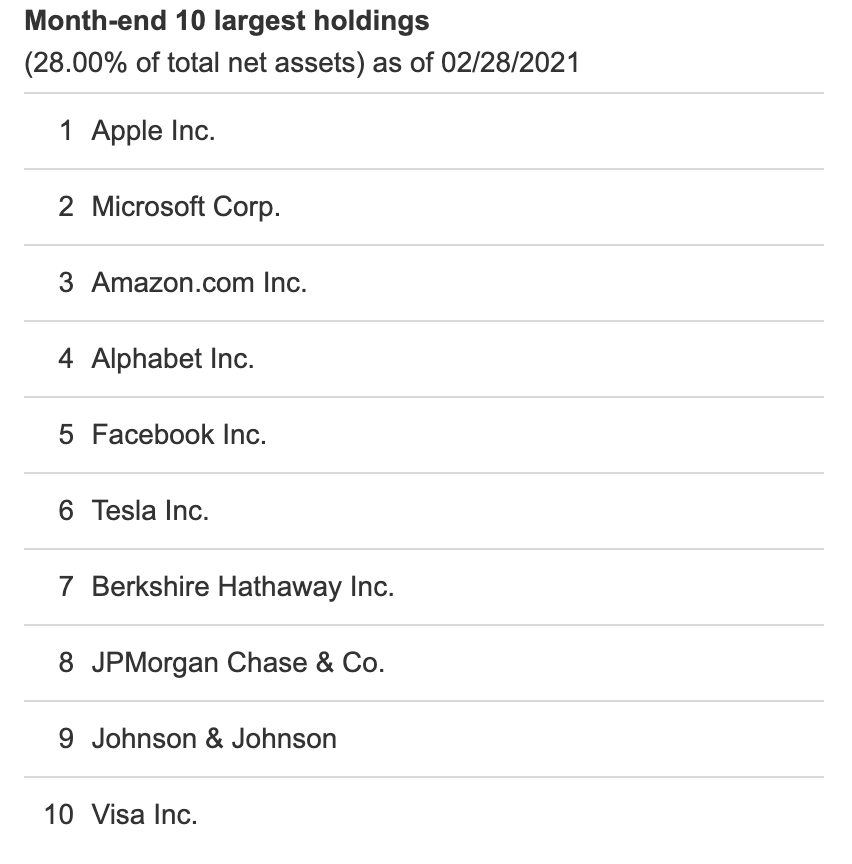

Living in the EU, I'm not allowed to purchase ETFs or trade Index Funds, so I'll build my own. My thinking at the moment revolves around simple methodology: Vanguard S&P 500 ETF ($VOO) is built out of 509 stock, whereby the top 10 represent 28% of the value. It's also what actually drives the S&P500:

So I'll just go and keep adding these 10 stocks to my own portfolio. I know that's far from being es-and-pee-diversified, but it's a poor man's DIY Index Fund. I'm considering this to be a nice starting point.

Investment Account C is a small, speculative account with some free trades and it allows fractional share purchases. I'm not sure what I'll do with it in the future, it's more for playing around. When I'll get tired of doing that, I'll just move the holdings into bitcoin and HODL it.

Income

We're a 2-income household. But I'm not counting my wife's savings or income and will just treat those as a backup/safety net. I'm paying all the bills, she spends her money on groceries.

My average salary is about €10K a month and it varies based on the commissions. In 2020, I brought home a bit over €120K net, so that's my basis for calculations.

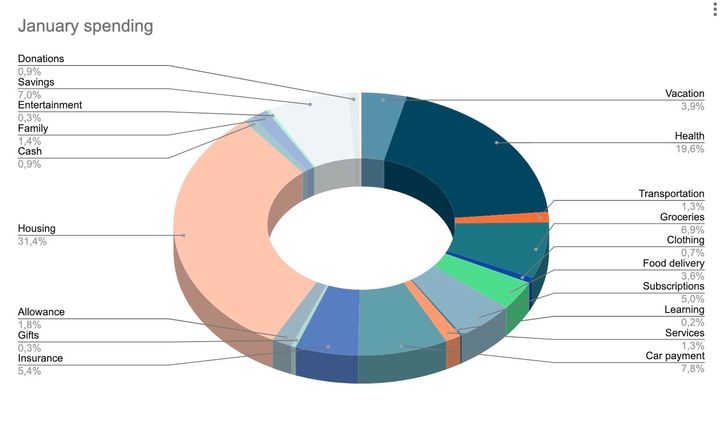

At the moment, I'm mostly saving over 50% of the take-home pay. In 2020 I spend a large chunk of those savings to repay the mortgage (over €60K in total).

My plan is to try to save at least 50% each month, and I'm always moving that to my cash savings account which prevents me from accessing the cash for 30 days. Since the markets are at an all-time high and we have crazy events signaling potential cataclysm, I'm considering having a nice amount of cash ready to invest at the next bottom. In the meantime, I'm investing smaller amounts every month (dollar-cost-averaging) and I'm not planning to eliminate any positions before the end of this decade.

Why 2030?

I haven't chosen 2030 because of a specific calculation, but because I see the turn of the decade as a potential milestone for a big life change. I enjoy my work and have a wonderful career with enough free time for my hobbies and interests, and I don't experience high stress. So there's nothing pushing me to get away asap. I'm just thinking that it would be nice to be financially free by 2030 so that I have an option to step out of the game if I choose so.

Why #FIRE?

There's no plan on what I want to do afterward, but I'm exploring some options. However, having financial freedom as a goal goes well with the #FIRE idea. Fortunately, as quite a high-earner, I have but a few spending sins. I'm not drinking alcohol, nor consuming meat, and I prefer to leave a simple life. My hobbies are yoga and running, and those don't cost much. Lately, I'm trying to explore spirituality (yoga on- and off the mat), and being frugal also speaks to my aspiration for simplicity and minimalism. It's a full circle.

Comments ()