Financial Independence vs. #FIRE

I'm studying the whole FIRE movement, trying to decide what's the right flavor of #FIRE for me:

- #LeanFIRE with the super-frugal approach feels more like that statement I once saw on Twitter saying that you're living miserable for 15 years, so you can live miserably for the next 30 years. Not for me

- #FatFIRE is on the opposite side of the spectrum, living fully and building wealth to continue doing so. I can see myself here, and I have the means to pursue it too.

- #BaristaFIRE is the mid-point, but it's like not knowing whether you'll fart or shit yourself. I don't like these half-baked things.

Retire Early motivation?

However, the more I read about it, the more it seems that the biggest driver for most of these folks is hating their jobs, their bosses, and trying to run away from it all. Lots of these individuals dread going to work and see the endpoint in saying Fuck You! to their superiors.

...

But that's not me. I enjoy my work, enjoy my team, my manager, and the executives. I love my customers and everything we're doing. Over the years, I've managed to optimize my workloads in a way that I steadily gave up the parts I disliked and doubled-down on my engagement with the parts I enjoyed. This helped not only make my work more joyous, but it also benefited the Company's stakeholders.

I'm working less than 20 hours/week

A lot of FIRE folks seem to hate having to work too much and too long hours. Again, that's not me. I'm a super productive individual and get to achieve my objective in less than half the time normally required.

For example, I just looked into the calendar for this past workweek. I spent a total of 8,5 hours in videocalls (WebEx, Zoom, Teams) and at most another 8,5 hours doing other work (email, chats, phone calls, preparing/delivering presentations). That's about 17 hours of work, and if we round it up to 20 hours, it's going to total about 80 hours per month.

... and I have plenty of of freedom during workweek

I also spent 5 hours in sports activities, mostly yoga and running. I've been writing for at least about another 5 hours, and reading for another 5. I also walk a lot, which would probably total another five hours, for a total of 20 hours doing non-work related stuff. —Note, that I'm only counting the workweek here, not the weekends (spent mostly with these same non-work activities).

I don't do any work-related stuff before 9 am, after 7 pm, or over the weekends. My e-mail is off, and the notifications distractions would pop up for less than a handful of very important individuals.

FI w/o the RE

The more I think about it, the more I realize that I'm not really looking for an early retirement, I just want to reach the financial independence and have an option to walk away or — more realistically — a fallback if I get invited to leave. In case I get fired vs. executing the FIRE ;-)

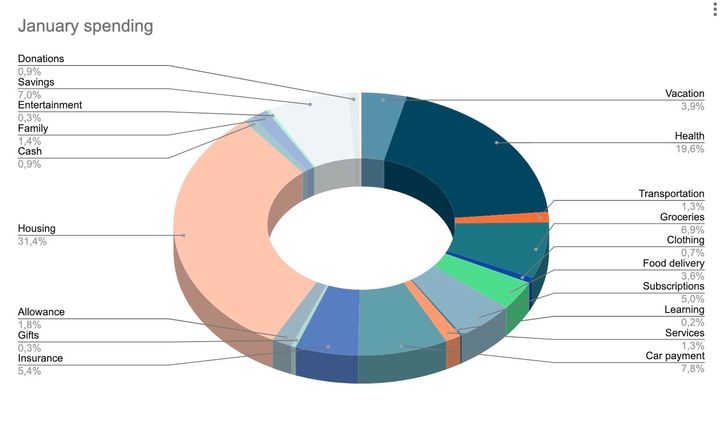

So I guess I have my goal for this decade — €2M+ net worth — and this will also help motivate me to stay frugal. I enjoy doing something with my money, and it feels right not to waste it.

The way I want to go about it is to ease in. I'm not counting my primary dwelling, which is currently worth ~€450K with a €84K of mortgage left, and neither I'm covering the rental unit (est. €175K, fully paid). But I will consider the rental income of €650/month as the money I get to invest and that gets counted towards the €2M goal. Same with the cash bucket, which is at €20K now, and I keep adding my 50% monthly savings to it. My plan is to keep investing whatever is over €20K. This gives me some cushion for short-term opportunities.

I'll outline my plan in the next post.

kaizen ɸ

🧘♂️🌱

Comments ()