Financial situation: March 2021

I'll be providing summaries at the end of each month, just to have a comparison on the status.

March income and savings rate

This month I had a smaller income due to lower commissions — €6,929,- and I added €3K into my savings account (43% savings rate).

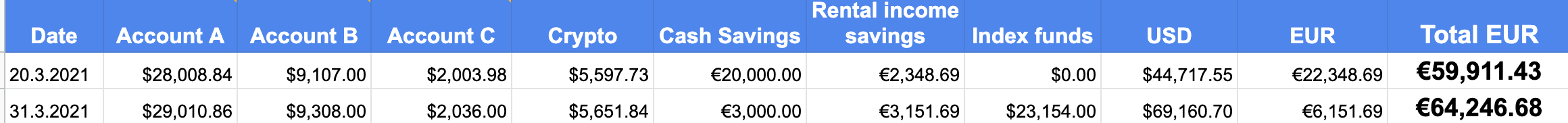

Savings and investments status

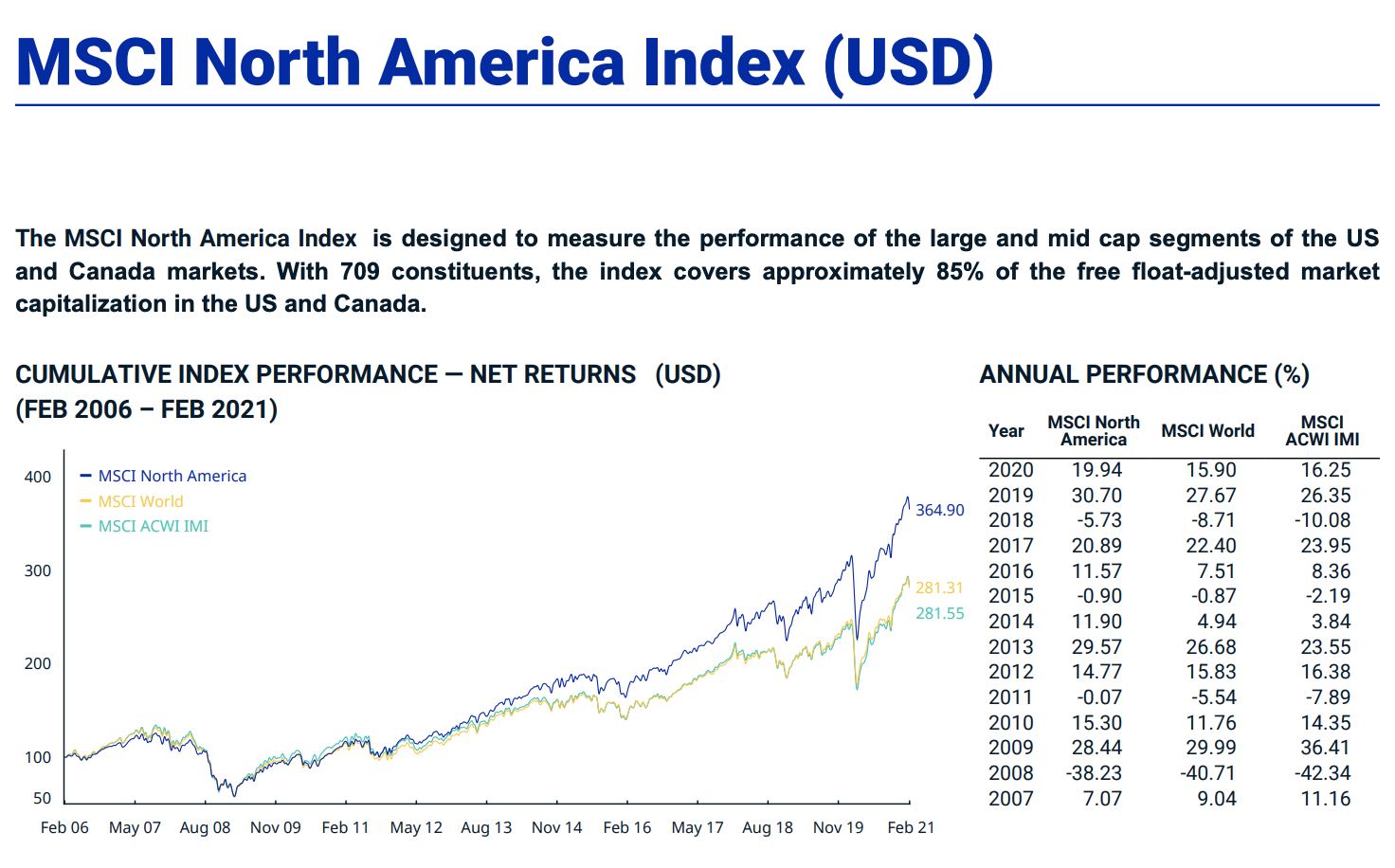

The bull market added some growth to my portfolio across all accounts. I've transferred €20K from cash savings into a new index fund which is benchmarked 100% with the MSCI North America Index.

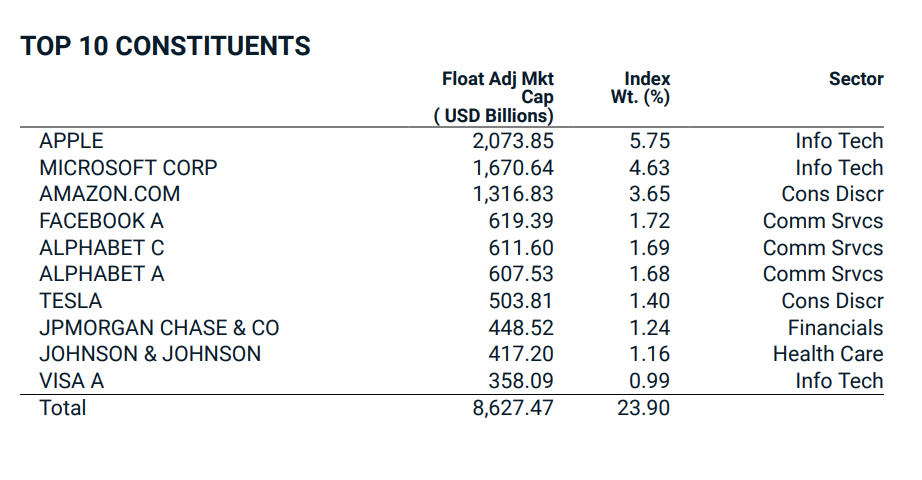

Looking at the top holdings, it's basically almost the same as the S&P 500:

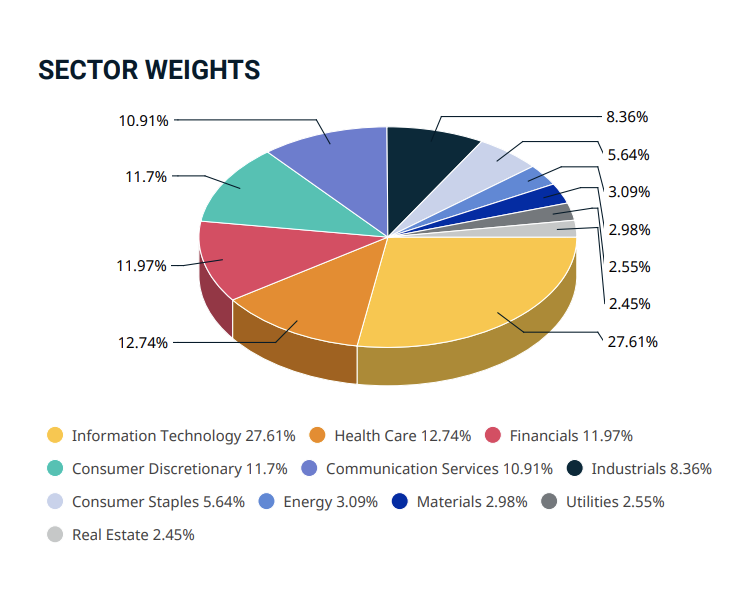

And the sector exposure:

All these are things that make me feel comfortable enough to invest my money into this index fund. I invested with a plan to leave those funds in there for at least 10 years, no matter what.

There might be a huge dip, but I won't need this money, and the investment gains tax drops to 15% after a decade.

Index fund benefits

In the past, I used to invest in index ETFs, but I refrained from index (mutual) funds because they didn't have the trading flexibility. I'd have to phone the bank and sign some papers to transfer or cash out. But today I'm wiser, so I see this as an actual benefit: putting the money in a boring financial product that isn't as easily tradeable. This will prevent me from cashing out at the wrong moment or paying high taxes on short-term gains.

The way I'd like to go about it is long. Observe and let it do whatever it does, leaving everything in for at least a decade.

Real estate vs. stock market investing

Since I have one rental unit, I do have some experience with that too. I'm fortunate enough to have very few worries about it, but it's an occasional hassle. Renters leave, or there's a leak, or whatever. What I like about it, is the constant flow of cash, those €650 a month feel like they could provide a decent living if I could scale them.

However, if I'd invest €175K into dividend-paying stocks and make it to a 4,5%-ish dividend, that would be the same level of income as the rent. Sure, the stock market fluctuates more than the real estate market, especially the market in my country, where it's super-rigid and only going up over the last decades. And the rents are going up all the time, they don't go down around here. Ever.

So even if the underlying property isn't as liquid as stocks, the truth is, I don't see its daily fluctuation. As long as the rent keeps flowing, I'm good.

Compare that to a stock market, where pricing is very visible and dividends get cut (here's someone burned by the likes of $ETP and $KMI). The stock market might be more volatile and nerve-wracking, but at the same time, there's no maintenance.

Having money in both, I keep wondering whether I should get rid of one and double-down on the other. But the truth is, I've got less than 25% of my investments in the public markets, while 75% is in that one rental unit.

If I'd count my primary residence into the equity, then the stonks would represent less than 9% of my current wealth. That's sobering. Having over 90% of my total wealth tied in one asset class probably isn't smart. Even in this country, where the real estate isn't as volatile as in the USA.

Pondering future investment activities

This realization makes me consider prioritizing stock market investing. Be it direct investments or index funds, that's where I'll pour more of my future savings.

That Account A up there, with the current value of $29K holds restricted stock from my employer will be fully vested by 2025, when it's going to be worth about $99K at today's prices. That will help with some reallocation, but at the same time I intend to strengthen both my trading accounts (especially Account B) and the index fund too.

Future savings & investing plans

Getting rid of these €20K set me free from the first-world worries of what to do with my surplus. Now I don't need to look at real estate investing or consider taking out another mortgage to add more rental units.

As I keep saving, my next milestone is when I save €20K again. I'm estimating that to happen within the next 3-5 months (by June or August 2021). That's when I'll decide whether I want to add those to this same index fund or add to my dividend-growth stock portfolio.

Enjoying the ride.

Comments ()