How my Net Worth dropped by €51K in 2022

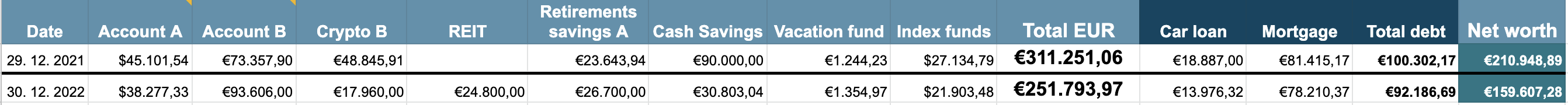

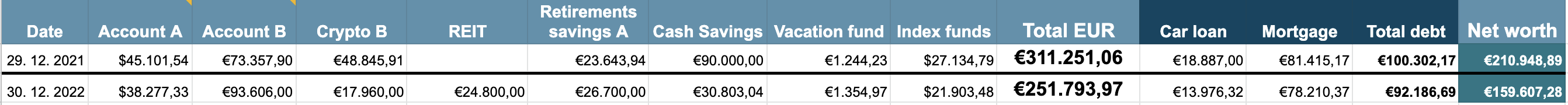

Looking at my Google Sheets file, my net worth dropped by €51.341,61 between December 2021 and December 2022. I chalk this up to a combination of macroeconomic (market) situations and some dumb choices.

For the record, I am not calculating my primary residence in my net worth since that's not something I plan on selling. At current market prices, it's worth about €500.000-

My portfolio

I have just a few different stock market investments: two index funds, a REIT, and one individual stock. The index funds are both tied to S&P 500, and the reason they are separated because I’ve done one through my European bank and the other through the online broker.

Index funds

In total, I invested about $120K in index funds, and I plan on adding there and “never” taking anything out. So I don’t mind the fluctuation as long as it goes up in the long run.

Individual stock / RSUs

That single stock are the Restricted Stock Units (RSUs) I get from my employer. In the past, I used to sell those and use them to repay my mortgage, but lately, I decided to let them compound as they vest and grow through an automatic dividend reinvestment program.

The average value of that RSU portfolio was $41K over the last twelve months, but that doesn’t include about $5K generated through a couple of years history of dividends. Typically, they generate about $300 of dividends per quarter, and over the next couple of years, the total vesting amount is expected to be about $150K.

I see that money as part of my “termination package” if the company decides to let me go at some point in the future. Until then, I believe we’re making the right choices, so I keep holding.

Employee Stock Purchase Plan

Recently, I also joined the Employee Stock Purchase Plan (ESPP), where I contribute 10% of my monthly net income to the program, which then purchases the company stock twice per year.

I’ll get at least a 15% discount on the price, and I plan on selling those purchases as they’re made, using the proceeds to repay my debt. It’s a great investment since it’s automated, done without my intervention (or a chance to decide against it), committed for a half year ahead, and it’s a way of “forced saving.”

The worst decision of 2022: crypto

I “lost” nearly two-thirds of the value I invested into crypto. In the past, I used to double my speculation and cash out. This time, I had more cash, which I diversified into index funds, crypto, and some REITs. The crypto part dropped from €46K in October 2021 to €18K in December 2022. Ouch.

Fortunately, I stuck to my crypto speculation policy to “invest” only as much as I’m ready to lose down to zero. And I decided not to cash out the losses, but let it in there for as long as I can (read: at least until it returns to the original value). Fortunately, I have no emergencies that would prevent me from waiting.

Real Estate Investment Trust

Another fund investment is a tradable European Real Estate Investment Trust (REIT). This one appreciated from €20,4K to €24,8K.

Retirement Savings

The Retirement Savings account isn’t something I’m really counting on for retirement; that’s why it’s such a low amount (€26,7K). I’m doing it because it provides annual tax relief in the same amount I invest per year (limited to about €3K), so I maxed that “free money” out. It’s also a life insurance policy, so my family would receive about €100K in case of my passing. I’m the main bread-bearer, so it’s important they have some insurance.

Debt

I’ve got two outstanding debts: a mortgage and a car loan. Combined, they total €92K, and I only cut them by about €7K last year. But I’ve got them in my cross-hairs for 2023.

The mortgage is at €78K, and in 2023 I want to repay it entirely. I don’t want any debt on my primary residence, and it’s peace of mind for my family. The car loan is at €13,9K at the moment, but I’ve got an offer from the bank to repay it for about €12,5K. I want to take it to reduce my debt burden. And I might go after this one first, just to feel a sense of victory. After all, it’s an easier “victim” to repay in one shot.

I want to tackle the big one without touching any of my existing investments (Index, REIT, crypto, RSUs). I’ll save cash from my salaries and also sell the ESPP at the time of purchase (expected twice within 2023).

Savings

The average savings rate for 2022 was only 15% (€20K) of my salary. This was somewhat intentional since I decided that 2022 would be my year of splurging, at least the way I understand that term. This included multiple stays in a fancy five-star hotel, where I took days off to work remotely, and indulge in saunas, champagnes, cigars, and room service dinners.

I also paid business class upgrades for many of my business trips, and that’s my simple way of living a luxurious lifestyle. What can I say, I’m a simple person.

Fortunately, my way of lavish lifestyle doesn’t include shopping and such things, it’s purely experiential, and that makes things easier even when I want to go “all out.”.

Going into 2023, I believe I’ve had enough of this splurging, at least for a while, and now I’ll be lavish about wiping out the debt and building my future financial independence.

So in 2023, I’m aiming for at least a 50% savings rate, and if I’d earn as much as in 2022 (€114K net), that would represent €57K in cash savings. But I plan on earning more since I got promoted, and I plan to get promoted again; plus, we have a regular annual salary increase, which should further accelerate my income and savings potential.

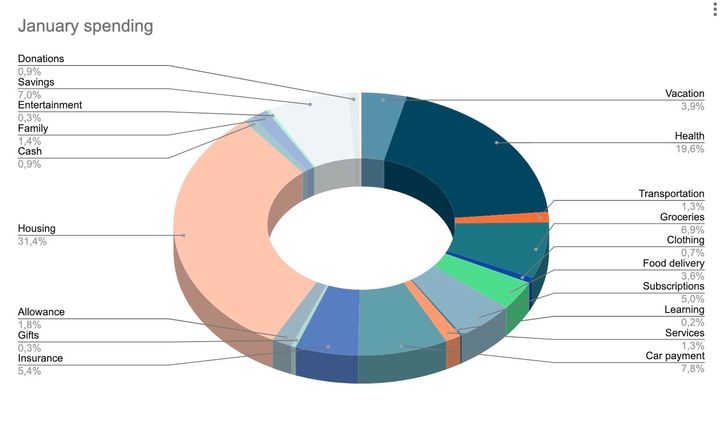

Budgeted Living Experiment (BLE)

The first thing I’m doing in 2023 is this thing I refer to as a Budgeted Living Experience (BLE). I never really lived on a budget, and this time I’ll force myself by setting the budget a €5K/month for a duration of three months.

Here's how this is going to work: I’ll transfer €15K from my savings to my transactional account, and for the next three months, I’ll put the entire salary into the savings account. This way, I’ll get €5K a month but still have some wiggle room to play with that inside a calendar quarter.

To prevent cheating, I’ll pay for everything with my debit card, except for the business-related expenses, which can go on my credit card. I get reimbursed for those amounts regularly after submitting the expense reports, so it shouldn’t be an issue.

I am really curious as to how it will go. €5K might sound like a lot to folks who earn much less than I do (the average net income in my country is about €1,5K), but for me, that’s a running cost that I expect to sustain me in a potential early retirement scenario.

If I ever decide to FIRE, I want to go for at least a chubby-FIRE, not any of those bankruptcy-level retirements. I want to afford a normal lifestyle, including some solo travels and family vacations. Five thousand euros a month, or sixty thousand a year, sounds like the amount of money to be able to afford that.

So this BLE is just a money-saving thing; it’s also a dry run for early retirement.

FIRE-sophy

My philosophy around early retirement isn’t entirely made up yet. I do know that I’m not the kind of a person who could find joy or even tolerate penny-pinching and an ultra-frugal lifestyle where I’d have to look at every single euro of spending. I consider myself a reasonably frugal minimalist who likes to have a bit of a wiggle room for occasional splurges, as described above.

As for the “retirement” part itself, I’m not really inclined or driven to call it quits. I love my job and the traveling lifestyle that comes with it. It comes with certain stress levels and annoying politics as a global corporate job, but nothing that would drive me so crazy that I’d like to quit. I also get certain fulfillment from the gig, and I can’t really imagine myself without it.

While I’m not looking for retirement, I am interested in the FI, the Financial Independence part of the concept. The idea of having the freedom to say No and not having to endure a shitty job just to survive has a certain appeal. And just having the peace of mind that comes with being financially independent really turns me on. I feel I’d enjoy my job even more if I knew I didn’t have to work for a living.

So here’s to new learnings, saving a ton of money, wiping out debt, and finding joy in it in 2023!

Recommended reading:

Comments ()