My financial best practices

I decided I'm not a penny-pincher but instead developed financial habits that work for me.

I guess these would be the main ones:

- A limited number of credit cards

- Multiple savings accounts

- Automated bill payments processing

- FinTech

- Savings as a (semi)automated process

- Diversified investments

- Building multiple income streams

- Separate finances

- Thank you, Covid!

A limited number of credit cards

I have only two credit cards, and I don't use either one for private stuff. One is there to pay for the business expenses such as flights, hotels, and business meals; the other is for the backup (and some travel benefits like lounge access). Whenever used, they are paid in full every month, so there are no interest payments.

Multiple savings accounts

I have 3 separate savings accounts, and I'm automatically contributing to them every month.

One is for my kids — a 5-year account to save some untaxed cash for them (€200/month).

The second one is our vacation savings account — I use to transfer all the per diems generated during my business travels, but these days I put in there €200 a month.

I use this to fund bigger family trips to exotic places.

The third savings account is where my tenants deposit monthly rents and expenses. I cover expenses from my primary account and save their payments. From here, I'll regularly deposit money into the brokerage account and invest in stocks. I leave on this account just enough cash to cover some basic rental property maintenance costs and annual taxes. Everything else goes into the stonks.

Automated bill payments processing

My bank automatically processes all my monthly bills. This doesn't cost me anything extra; it's included in the €13- monthly fee for the debit and credit cards. This brings me peace of mind for not having any overdue payments and also takes care of automatic transfers to my savings accounts.

FinTech

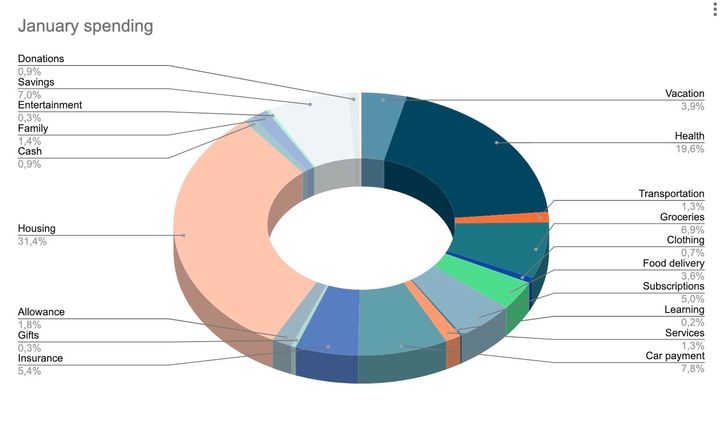

I rarely use my primary debit card. It serves more as a backup. Each month, I transfer €1.000- to my prepaid fintech account, and that's my monthly spending budget. €250 per week covers some groceries, gas, and any other discretionary purchases.

Let me state that this isn't our family's entire grocery budget — my wife is buying most groceries with her own money. I pay the bills, she does the grocery shopping, and I usually spend something on top to cover my special dietary preferences.

This FinTech account is also where I'm holding some stock fractions (~$2K), some crypto (~$6K), and smaller cash savings.

Savings as a (semi)automated process

I mentioned above how some of my savings deposits are automated. But the majority is semi-automatic, as I can't predict exactly how much I can save each month. My general goal is at least 50% of monthly income, and it's usually more (even 70%). But I wait for the payday to see how much commission payments I got, then deduct my fixed expenses and automated savings, and whatever is left goes into the savings account. This is the same account where the rental income is held. I'll usually wait till I generate about €20K of savings and then make a lump-sum investment.

Diversified investments

Looking at my entire net worth, including my primary residence, most of my wealth is in real estate. My focus is to build more liquid long-term investments, primarily in the stock market, either via direct purchases or index funds. I've got at least about €65K (~$76K) of such investments at the moment, and I plan to keep building that.

At some point in time, I'll probably add another rental unit. I like that steady income stream, and it feels more tangible than the stonks.

The interest rates are at an all-time low right now, and the banks are offering even 25-year mortgages at a fixed, 1,75% interest rate. It's a steal, but on the other hand, the property prices in my domicile are also at an all-time high. Income would potentially cover the mortgage payments, but overall returns are quite poor.

Separate finances

My spouse and I have separate finances. As mentioned earlier, I pay the bills; she does the groceries. Her income is quite good as well, so she's got a nice pile of savings too, but I don't know how much. And I don't care. I'm looking at my part as something that will bring us to FI and will consider whatever she brings to the table as a surprise.

I'm happy that we never need to discuss money because we have enough, and we're both decently frugal. We enjoy spending on vacation and travels and a bit less on shopping, and we both find wasting money on cars stupid.

Thank you, COVID!

With all due respect to anyone who's lost someone or those that have lost their jobs or found their businesses bankrupt, but I have to state that this pandemic has been kind to me — financially, spiritually, and in terms of my relationships.

Financially, there is no better way to spend less money. I haven't purchased almost any new clothes since March 2020. No shoes, suits, shirts, nothing. Estimated savings: up to €2K in a year.

With shops, restaurants, and bars closed for most of the time, I saved at least another €3-5K that I'd normally spend on lunches, dinners, and beer evenings with friends.

There was no skiing nor annual exotic trip, so that's another €15K (judging by the 2019 spending).

So it's safe to say that the pandemic has helped me save additional 20-25 thousand euros. I'm not expecting the previous lifestyle to resume before 2022, so I'm looking at around 30 thousand euros in savings. I used most of that money in the past year to significantly cut my outstanding mortgage.

The pandemic also allowed me to spend more time with the family and with myself. I've been growing spiritually, maintained healthy fitness and dietary habits, and grown as a human being. I'm happy to say that I'm okay with the way things are, not desperately waiting for the pandemic to finish nor dreading that period.

I know I'm coming out as a better person on the other end — whenever that end comes.

Comments ()