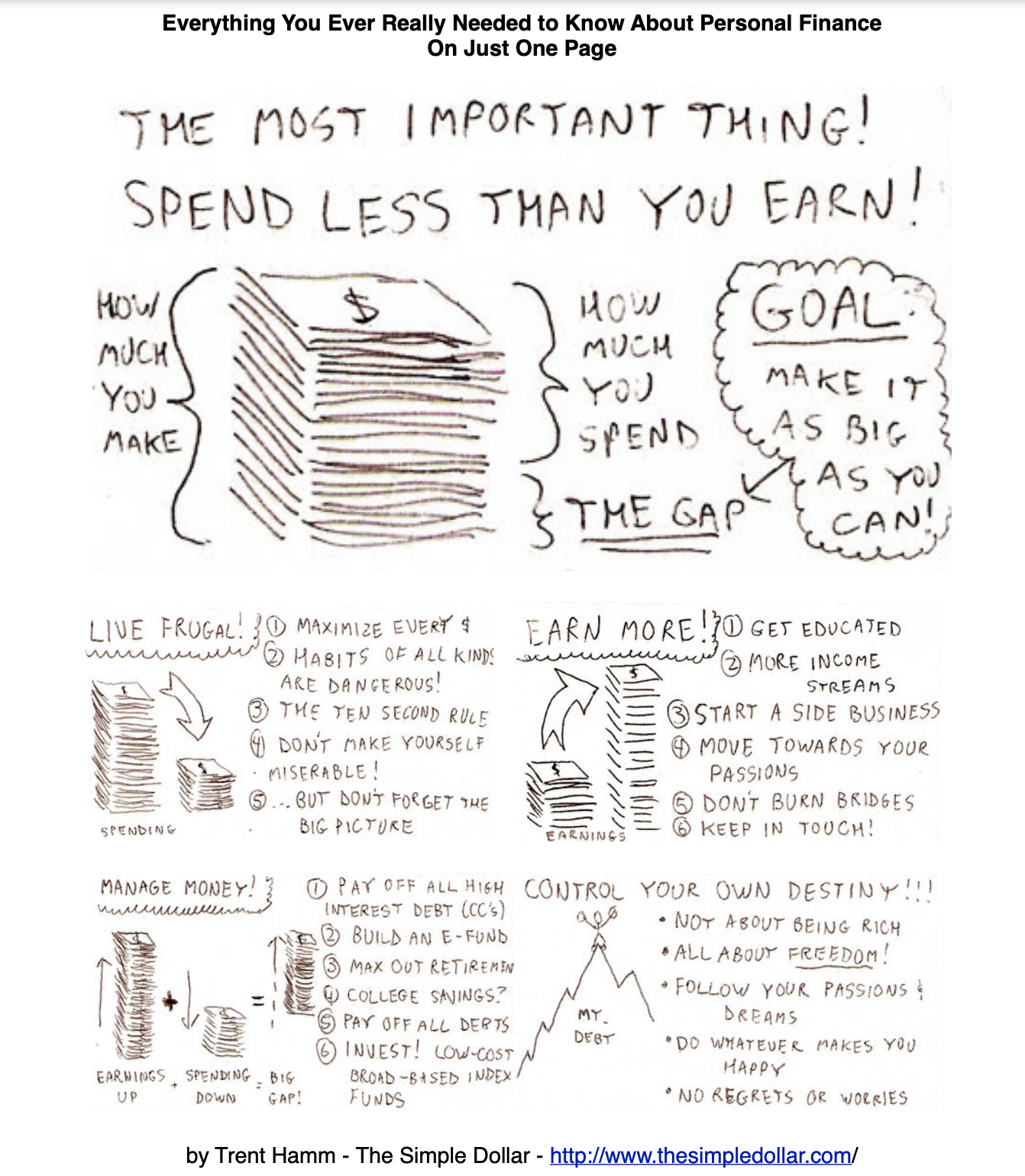

A simple 5-step personal finance plan

Spend less than you earn, make more money, and live frugally. Do something sensible with the difference. Control your own destiny.

Spend less than you earn

The first step to financial stability is simple: spend less than you earn. But in a world where we're constantly bombarded with messages to spend, save, and invest, it can be hard to stick to this basic rule.

One way to make it easier is to change your mindset around spending. Instead of thinking of money as something that you need to spend as quickly as possible, start viewing it as something that you need to conserve and use wisely. When you make a purchase, ask yourself whether it's something that you really need or if you're just succumbing to a moment of impulse buying. Chances are, if you can wait a day or two before making the purchase, you'll realize it's not worth your hard-earned cash.

So next time you're tempted to splurge, remember: the key to financial success is spending less than you earn.

Earn more!

Who doesn't want to earn more money? We all want to be able to live a comfortable life and not have to worry about money. And while there are many ways to earn more money, there are also many ways to spend it. So what's the best way to make more money? The answer may surprise you: by spending less of it!

That's right, one of the best ways to increase your earnings is to decrease your expenses. You can free up more money to invest in yourself and your future by cutting back on unnecessary costs. So if you want to earn more money, start by spending less. You may be surprised at how much your earnings can increase.

Live frugally!

If you're looking to save some money, you may want to consider living a frugal lifestyle. Frugality isn't about deprivation - it's simply about being mindful of your spending and making choices that align with your values.

For example, rather than buying new clothes every season, you might choose to shop second-hand or invest in timeless pieces that will last for years. You might also cut back on unnecessary expenses like dining out and subscription services and opt for more economical alternatives like cooking at home and streaming free content.

Living frugally doesn't mean you have to live like a hermit - it just means being more conscious of your spending and making smart choices with your money. So if you're looking to save some cash, why not give frugality a try?

Manage Your Money!

Being good with money doesn't just mean having a lot of it. It also means knowing how to manage what you have so it lasts. That's why it's essential to start developing healthy money habits as early as possible. Here are a few tips to get you started:

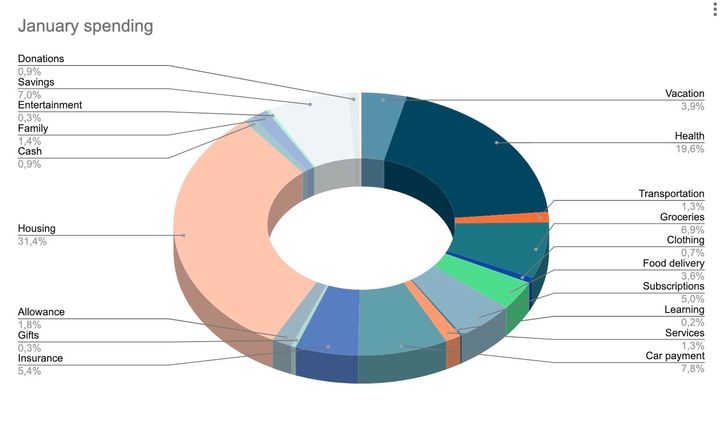

First, always know where your money is going. Track your spending for a month and then analyze where you can cut back. You may be surprised at how much you're spending on unnecessary things.

Second, make a budget and stick to it. Force yourself to live within your means and only spend money on truly essential things. This will help you save money in the long run.

Third, don't be afraid to invest in yourself. Investing in your education or taking on extra work now will pay off later down the road.

Fourth, always be prepared for the unexpected. Set aside some money each month so that you have a cushion in case of an emergency.

You'll be on your way to financial success by following these simple tips!

Control your own destiny

If there's one thing we can all agree on, it's that life is unpredictable. You can plan and prepare all you want, but ultimately you can't control everything that happens. That's why it's important to take control of the things you can control. One of the most important things you can control is your destiny.

Now, when we say "destiny," we're not talking about becoming rich or famous. We're talking about the freedom to do whatever makes you happy. To live your life without regrets or worries. To be in control of your own happiness.

So what are you waiting for? Start taking control of your destiny today! Do whatever it takes to make your dreams a reality. After all, life is too short to waste time worrying about things you can't control. Live your life to the fullest and enjoy every moment!

Conclusion

So there it is in a nutshell:

- Spend less than you earn,

- make more money,

- and live frugally.

- Do something sensible with the difference.

- Control your own destiny.

That's the secret to personal finance success, and it really is that simple (or at least it should be). Whether you want to buy a house, retire comfortably, or just have some extra spending money each month, following these basic tenets of financial health will get you there.

Of course, like anything else in life, nothing comes easy, and there are no guarantees – but if you don't try, you definitely won't succeed. Are you ready to take charge of your finances and start building a brighter future for yourself?

Check out these posts:

Comments ()