Corporate America is the best thing that happened to this European

Listening to the Inspire to FIRE Podcast, I heard some things that resonated with me. Corporate America has become an expression for bad, careless capitalism, but it has also been a great factor in upward social mobility.

(Ab)using people

Sure, there are tons of bad stories out there, and Hollywood has helped ingrain these in our collective memories, but the truth is, the success stories are just too boring for the big screen.

We have well-documented the stories of burnt-out employees, but there are a few success stories. They are boring. Just like mine: I started working for the American Corporation just after the dot-com bust, got a ton of practical knowledge, had wonderful mentors, and I've grown my income year by year ever since. I have actually doubled my total compensation from one year to the next — twice (so far). That's not abuse. It's performance pay, combined with mindful time-management and career design.

Accelerating success: US vs. EU Corporations

For many people, myself included, Corporate America has been the best alternative to entrepreneurship in quickly raising my income levels. When I entered the corporate world decades ago, they trained us well, and what many have frowned upon as brainwashing, some of us have recognized as great learning opportunities.

Corporations have been the best way to learn how to be productive, efficient, fast, and develop repeatable success within shorter time frames. While lazy European corporations live in their yearly bubbles, most publicly traded US corporations run in quarterly cycles. That's four cycles versus 1 in a year, and I firmly believe it's what makes the US companies grow faster. And bigger.

Growth opportunities for everyone

Those first trainings and subsequent on-the-job learning opportunities resulted in turning average individuals into top performers. Sure, there was filtration, and many haven't survived, or they only made it till the first rounds of reorganizations, layoffs, popularly acronymed as RIFs (Reduction In Force).

Accelerators for the best

But let's face it — companies rarely let go of their best talent. What I've seen was an opportunity to be so good you actually are indispensable. From early on, I made sure to work hard, apply myself, and lean into the corporate culture. That made everything so easy and effortless, so I never dreaded going to work, and it also helped me be more successful.

Linchpin

I first heard of the term when reading the book Linchpin in the 2010s, and I realized that what I've been doing my whole career has a name.

Over these decades, I've witnessed at least a dozen reorganizations, and I've never found myself on the list. At least not on the bad one, but I've made it to a Crucial Talent list a couple of times. Those are lists of people that corporation absolutely wants to keep, and they'll often reach out to them before the reorg to make sure they're clear about being safe and critical.

Growing income streams

My first annual corporate salary was about €25K. Back then, that was double compared to what my parents made in the last third of their working careers. Over the next couple of years, that got spiced up with additional annual bonuses adding up huge bucks. Lifestyle inflation and living it out helped me spend it all.

At the first big job change, I bumped my salary up to €40K. They paid that to get a hold of my corporate experience and learnings. It quickly rose to €60K a year.

After three years, I switched jobs, and my annual pay went to €90K. Then to €120 within two years and to €140K after a few more, and then over €160K.

Until the €140K-level, I mostly lived paycheck-to-paycheck. It was a fat living, throwing the money around, not really thinking about anything.

Stop the bleeding

At some point, I realized that I'm actually poor if I lose my job. Almost no savings, a big mortgage, and a single income. Unhealthy.

Living in the EU, we don't worry much about healthcare (it's free or included in the high taxes, you might say) or retirement (also taken care of from the government's high taxes). Schools provide free education for the kids, no pressure there.

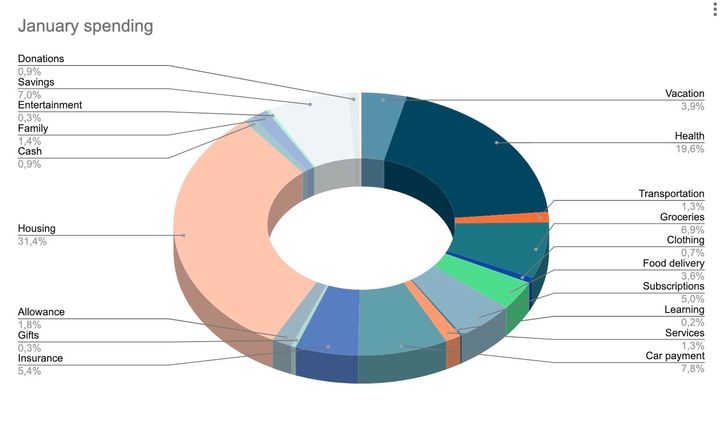

Still, I realized I need a cushion, more income streams, and some vision. That's when I started saving big and made a couple of lump-sum mortgage repayments. At the same time, we moved to a bigger space, so there was another mortgage, but I started renting out the first unit. The monthly rental income covered 2x the outstanding mortgage, and I soon repaid that.

I've got a much better financial situation now, and it's time to pursue Financial Independence.

Thank You, Corporate America!

You raised this European hopeless idiot out of a low-income caste. You gave me everything I ever wanted and provided a safer alternative to entrepreneurship with less stress and much less risk. I'm hoping more people figure out this is a great way to lift their financial standing. It might not sound as cool as I started a company, but it's a viable alternative with what might be a limited upside but a significantly limited downside.

Right? What do you think? Hit me up on Twitter, or drop me a DM.

Comments ()