Financial situation: May 2021

I shared my last update at the end of April:

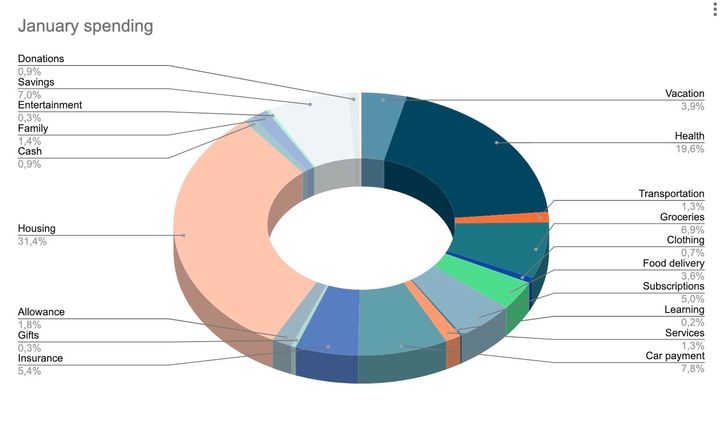

May income and savings rate

My May income was €8,9K and I transferred €3,5K into my savings account. The reason for lower that 50% saving rate is simple: I'm furnishing a new apartment, which costs money, and I prefer to pay cash.

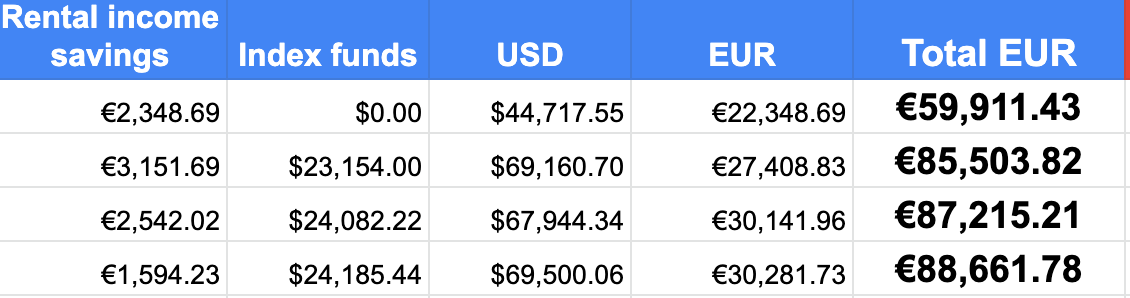

Savings and investments status

Making slow progress. I added more ETFs to my primary investment account, and I'll keep contributing to it.

Account A keeps growing in value — both because of our company's stock price, as well as because of automated dividend reinvestments (DRIP-ing). Within the next quarter, I'll have more shares vesting and that account's value will go up significantly.

I'm not adding anything to Account C, so that's pure growth of the two holdings (mostly fractional shares).

I pulled out a chunk of crypto for quick cash access last month, and now it also dropped in value. So I guess I got a nice chunk out at the peak.

Even though I added €3,5K to my cash savings account, it only grew by €800 due to taking the money out in the prior month (renovation project).

The rental income account is lower as I used it to pay 2020 taxes. While I'm not renting this property out anymore, I'll be paying the rent to myself — at €500/month, the net after-tax equivalent of what I used to make.

This is a sort of forced-saving which I'm sure to benefit from in the future.

Next month's financial plans

My overall net value keeps increasing, and my debt keeps dropping. Fortunately, at the same time, also the property values keep growing, so I'm happy with my total net worth.

I keep remaining frugal, even with some unplanned expenditures around furnishing the place. I'm paying most of that out of regular income, so there's no debt, just fewer savings.

Earn a ton, spend a little, save and invest a lot.

Carry on.

Comments ()