Financial situation: April 2021

I shared my first update in March, then shared another update, and now I'm developing my spreadsheet to follow more things.

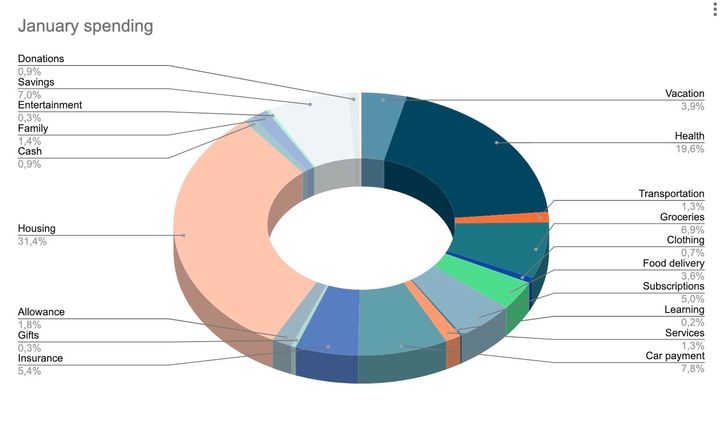

April income and savings rate

The total payout for April was €7,074.03 and I transferred €3K into my cash savings account — for a 42% savings rate. That's below my fifty percent goal, but I'll accelerate in the coming months.

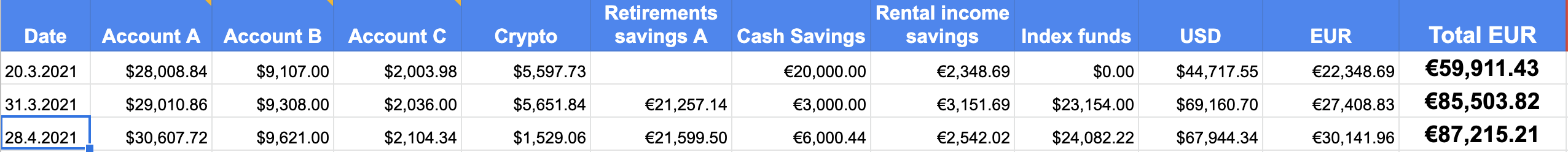

Savings and investments status

The markets keep growing and that's reflected in my stock market accounts. The Retirement savings are a crappy low-risk mutual fund, but the main reason I'm contributing is the annual tax deduction, so I'm fine with that.

The drop in crypto was me needing some quick cash which isn't subject to taxation, so I took some out when bitcoin was at its April heights.

The Rental income savings account dropped because I used the cash to pay the 2020 rental income tax. This amount will further drop next month as I'm changing the tenants and doing some renovations.

I'm happy to see that the Index funds are growing as well — I only opened that account last month. But I better be stoic once a correction comes.

Even with pulling out cash for vacation and tenant churn, my net worth increased by over €2,2K. Nothing to write home about, just slow and steady. And boring —like long-term investing should be.

Next month's financial plans

With the real estate market at an all-time high, I'm toying with the idea of selling my rental property. The estimated market price is at €185K, which would provide me a hefty profit over the purchase price (€150K).

But I wouldn't be ready to invest that full amount in the stock market. I'd buy a smaller property, but then what?

On the other hand, I'm considering using it myself. Between the current office expenses and this one, it might be a viable choice. Of course, then I'd no longer have any rental income, just costs with it. But this isn't a financial decision; it's an emotional one.

I can afford to live there, the costs are relatively low (~€150/month), and I'm thinking that more free time with less distractions will allow me to launch additional online businesses that might eventually cover those costs.

I'm good with the income and the savings, and I don't see any need to tap into my investments in the foreseeable future. But I'd like to further diversify my income, so I'll be vigilant about that. Additional rental units are out of the question at these prices. This leaves the stock market including the index funds or some business investment.

While I have zero influence on the stock and the real estate markets, I do have 100% control over my actions. So I'll continue doing a good job to receive good pay while remaining frugal.

Coasting along.

Comments ()