Financial situation: October 2021

I had a big jump in my total savings and investments. I decided to diversify the proceeds by putting 1/3 in crypto, 1/3 in index funds, and spending 1/3 on cocaine and hookers.

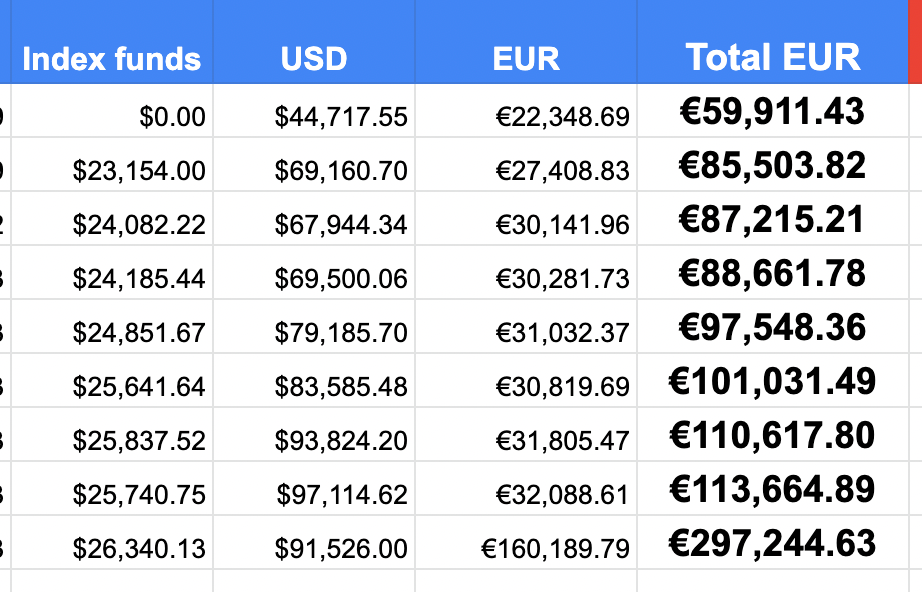

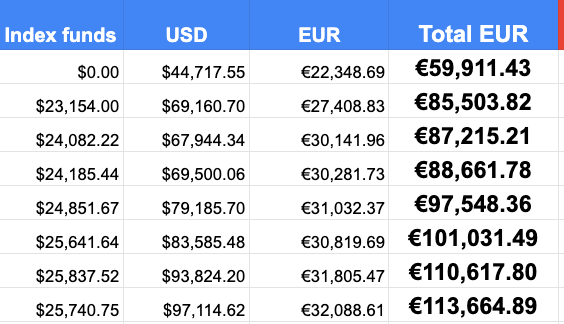

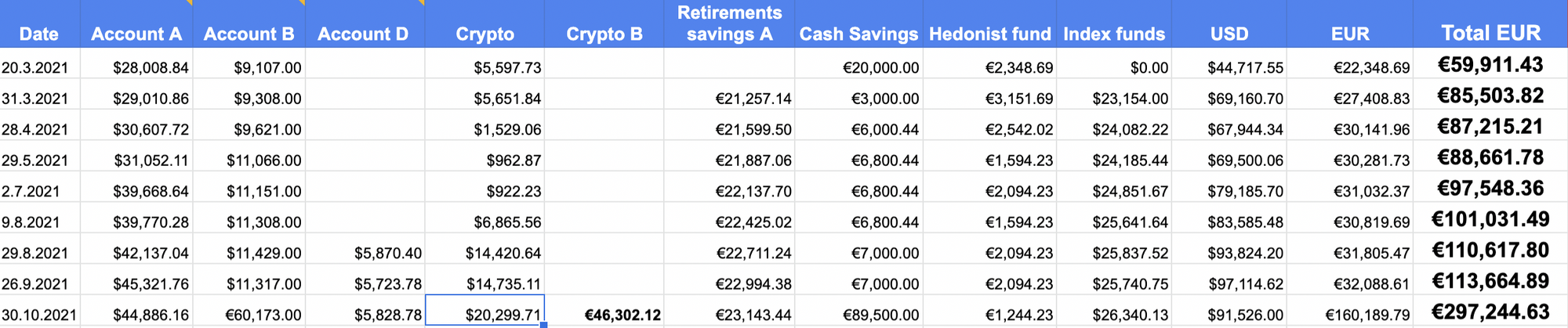

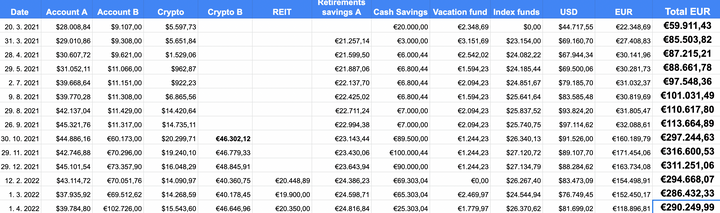

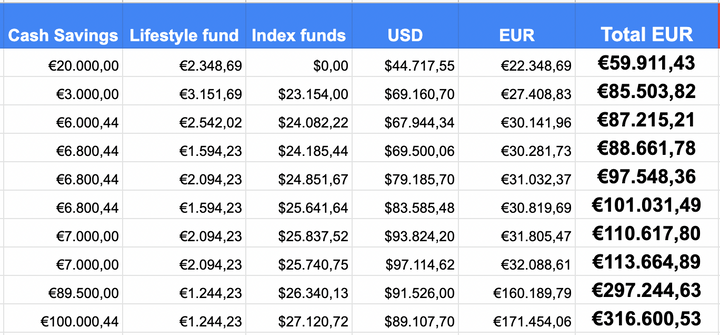

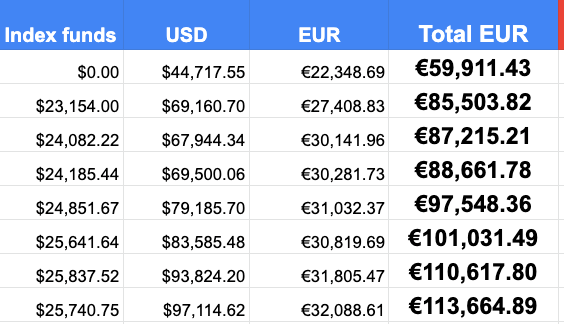

I shared my last update at the end of September 2021:

October income and savings rate:

My October income was €6,853.37, and I only transferred €1K to my savings account. It was a spending month (personal travels), and I allowed myself a lower saving rate because of closing on a real estate deal, which beefed up my overall savings anyway.

Savings and investments status:

I had a big jump in my total savings and investments. I decided to diversify the proceeds by putting 1/3 in crypto, 1/3 in index funds, and spending 1/3 on cocaine and hookers.

That last was a joke, of course. But as you can see, I've put €82,5K on my savings account as I don't yet have a solid idea where to put it.

The amount that is now on the investment Account B is getting invested in the FTSE All-World Accumulating index fund, but I'm doing it slowly — by investing €10K per month. This means there's still €40 lying in cash, to be invested over the next four months — to get some dollar (euro) cost averaging action and slow my investment itch down.

With the markets at all-time highs, and the party lasting for such a long time, I am of those who worry about a correction. But I don't want to sit with bags full of cash on the sides; I still want a piece of the action. So I'm investing slowly, month by month. And once these €40K are invested, I plan on tapping into the €89,5K currently sitting on the savings account.

The logic of my index fund investing is long-term anyway, so I shouldn't worry where the markets are tomorrow but believe that they'll be higher in 2030. I do believe that, but I'd still like to do my best to avoid (or capitalize!) on some short-term correction.

And I'm also hoping to get some startup/angel investment opportunity to diversify further. I'd be willing to invest up to €50K in startup ideas at the moment, but not all in one. At least two ideas and founders that I could help kickstart and grow their business. I remain vigilant.

If I don't get any good ideas, I might fully repay my car's leasing, thus bringing an additional €500/month to save. BUT, I'm not sure about WHY I'd do this since I have no solid ideas of where to invest my current stash anyway ... so maybe it's easier to keep repaying those leasing annuities.

Next month's financial plans

November is typically a pretty frugal month and belongs into those six months when I plan to save 50% or more of my income.

I believe I've found a nice balance between saving and living well. My #FI2030 route isn't about making the 2020's miserable; it's about finding the best way to live reasonably well while building the Castle of Financial Independence.

Soldier on.

Comments ()