Financial situation: September 2021

I shared my last update at the end of June 2021:

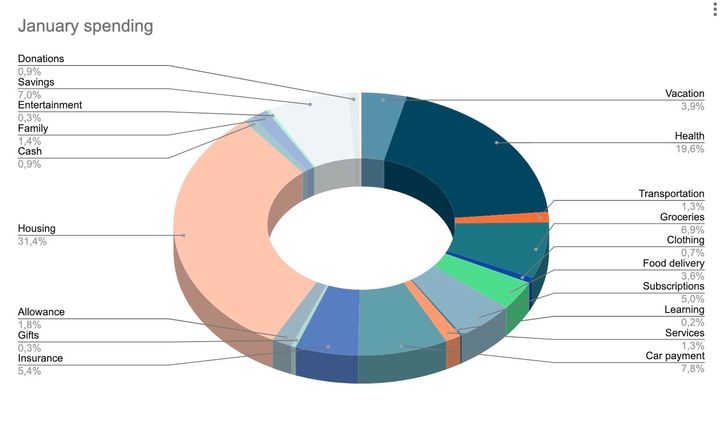

September income and savings rate:

My September income was €6,391.94, and my transactional account is pretty beefed up with €8K laying in there, but I'm not sure I'll be transferring anything into savings this month. For one, I have many expenses coming up, like paying for training/education, which I deem as an investment into my (future) self.

I've also been spending a lot of money lately, giving into some hedonistic lifestyle after years of frugality. I'm enjoying it while still doing well. I am currently in the last phases of closing on a real estate deal, so I'm expecting a larger influx of cash. A windfall of sorts. And all of that will go into investments.

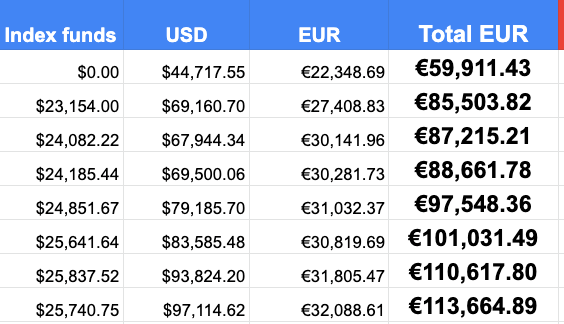

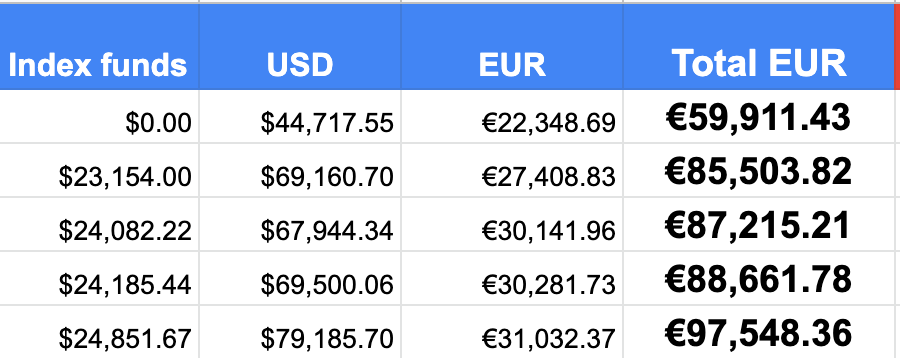

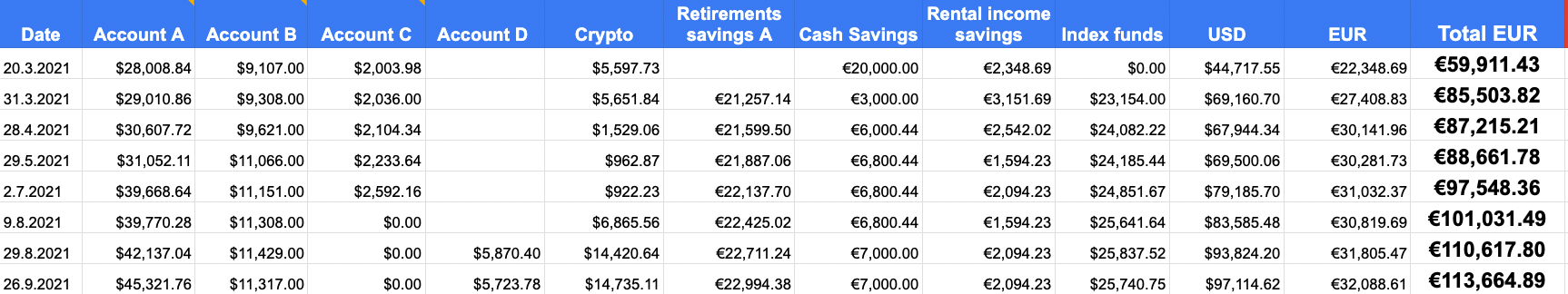

Savings and investments status:

Overall I see a small climb in total EUR value, most of it coming from the rise in my company's stock price climb, a bit offset by a modest decline in some other investments — like the copied investment account, crypto, and the index funds. The markets are showing some stall, perhaps signaling that the winter is coming.

Next month's financial plans

I mentioned the expected October windfall, which will more than double my overall financial value. I plan to diversify that into investments, keeping some of it on the savings account, investing some in crypto, and the rest in the index funds. But since I'm expecting that the thirteen years of economic growth might soon turn the tide, I'll be slow with investing the money. I'll transfer cash into the investment accounts but then slowly buy month by month.

I plan to keep those investments rolling for at least a decade, but I'd still hate to see them all decimated by some sort of a 2022 crash. If that happens, I'm expecting that the real estate market will see a correction as well, so I might invest in some rental property again. But only if I'll be able to see some good mathematics with it.

Saving strategy update

As far as my goal of saving 50% of the monthly income is concerned, that's dropped to 32% on an annual level now, but I do plan on returning there in October.

I've gotten a bit fed up with being so frugal at my levels of income. So I'll mix things up by having certain non-saving months. Those will be:

- May: usual May-holidays trips with the Family.

- July & August: summer vacation.

- October: autumn school holidays.

- December: Christmas Family trips to warm exotic places

- February: skiing holidays.

This will give me 6 months on & 6 months off the 50% savings train. That should still allow me to stay on the good track towards reaching Financial Independence in 2030. #FI2030

And considering my income during those saving months increases due to bonus checks, I'll still achieve more than a 50% annual savings rate.

Soldier on.

Comments ()